Business Insurance in and around Louisville

Calling all small business owners of Louisville!

Insure your business, intentionally

Help Protect Your Business With State Farm.

Preparation is key for when a mishap happens on your business's property like a customer slipping and falling.

Calling all small business owners of Louisville!

Insure your business, intentionally

Customizable Coverage For Your Business

Planning is essential for every business. Since even your brightest plans can't predict product availability or consumer demand. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for uncertainty with a State Farm small business policy. Business insurance protects more than just your facility or shop.. It protects your hard work with coverage like extra liability and errors and omissions liability. Fantastic coverage like this is why Louisville business owners choose State Farm insurance. State Farm agent Joe Watson can help design a policy for the level of coverage you have in mind. If troubles find you, Joe Watson can be there to help you file your claim and help your business life go right again.

So, take the responsible next step for your business and get in touch with State Farm agent Joe Watson to investigate your small business insurance options!

Simple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

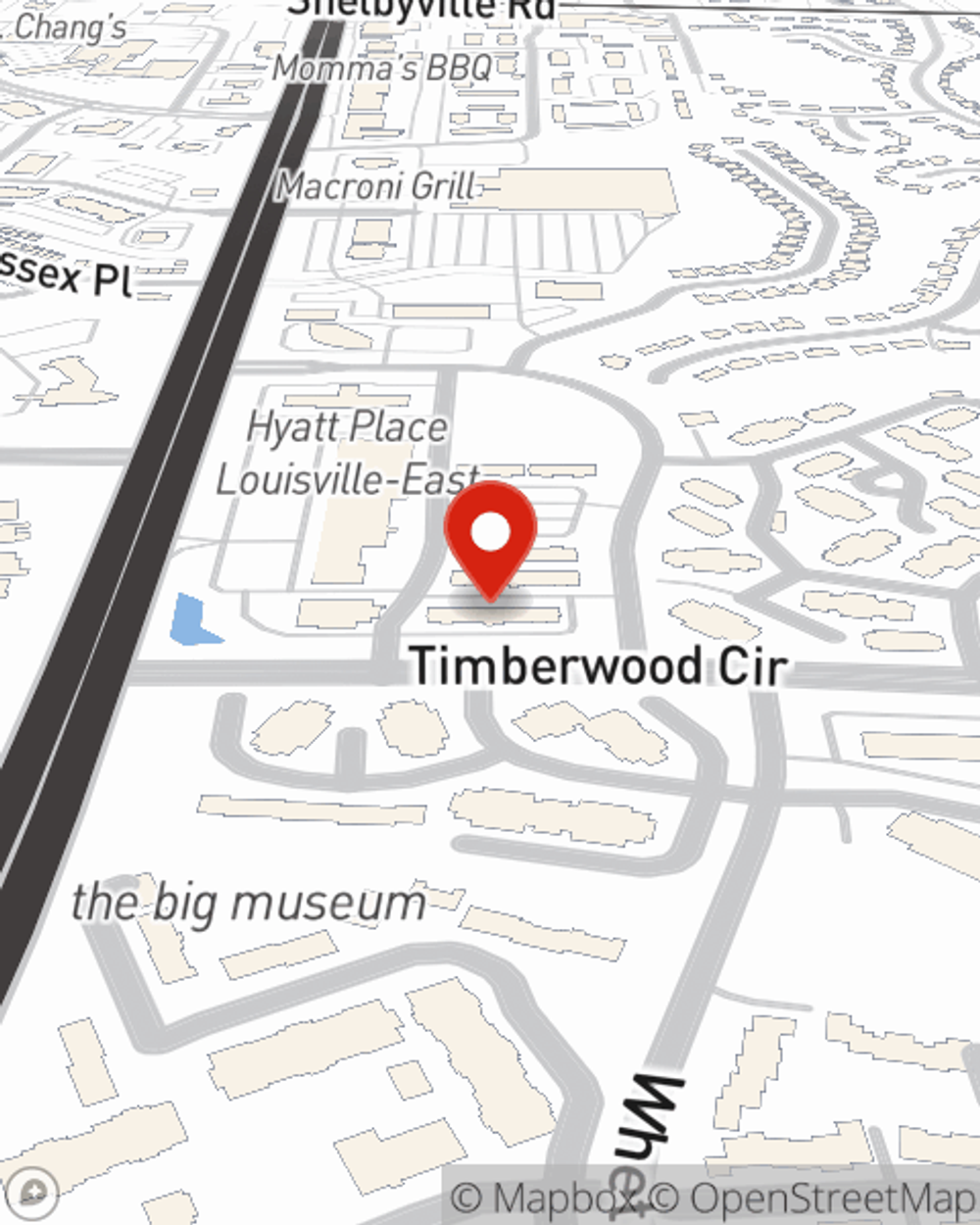

Joe Watson

State Farm® Insurance AgentSimple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.